Decentralized Exchanges: A Comprehensive Analysis of Market Dynamics, Innovation, and Future Outlook in 2025

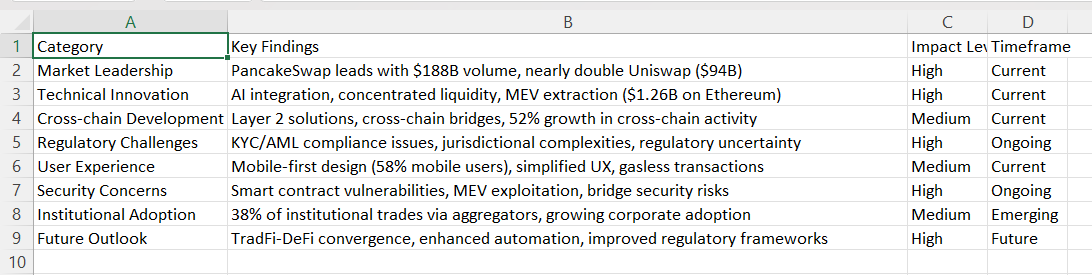

The institutional adoption trend, evidenced by 38% of institutional DeFi trades flowing through aggregation protocols, signals a fundamental shift toward enterprise-grade decentralized finance.

The decentralized exchange (DEX) landscape has undergone a dramatic transformation in 2025, emerging as critical infrastructure that now processes over $412 billion in monthly trading volume and serves more than 14.2 million active users globally. This comprehensive analysis reveals a rapidly maturing ecosystem where PancakeSwap has claimed market leadership with $188 billion in monthly volume—nearly doubling Uniswap's $94 billion—while technological innovations in artificial intelligence, cross-chain interoperability, and Layer 2 scaling solutions are reshaping how traders access decentralized liquidity.

Author: Sangamesh Badachi

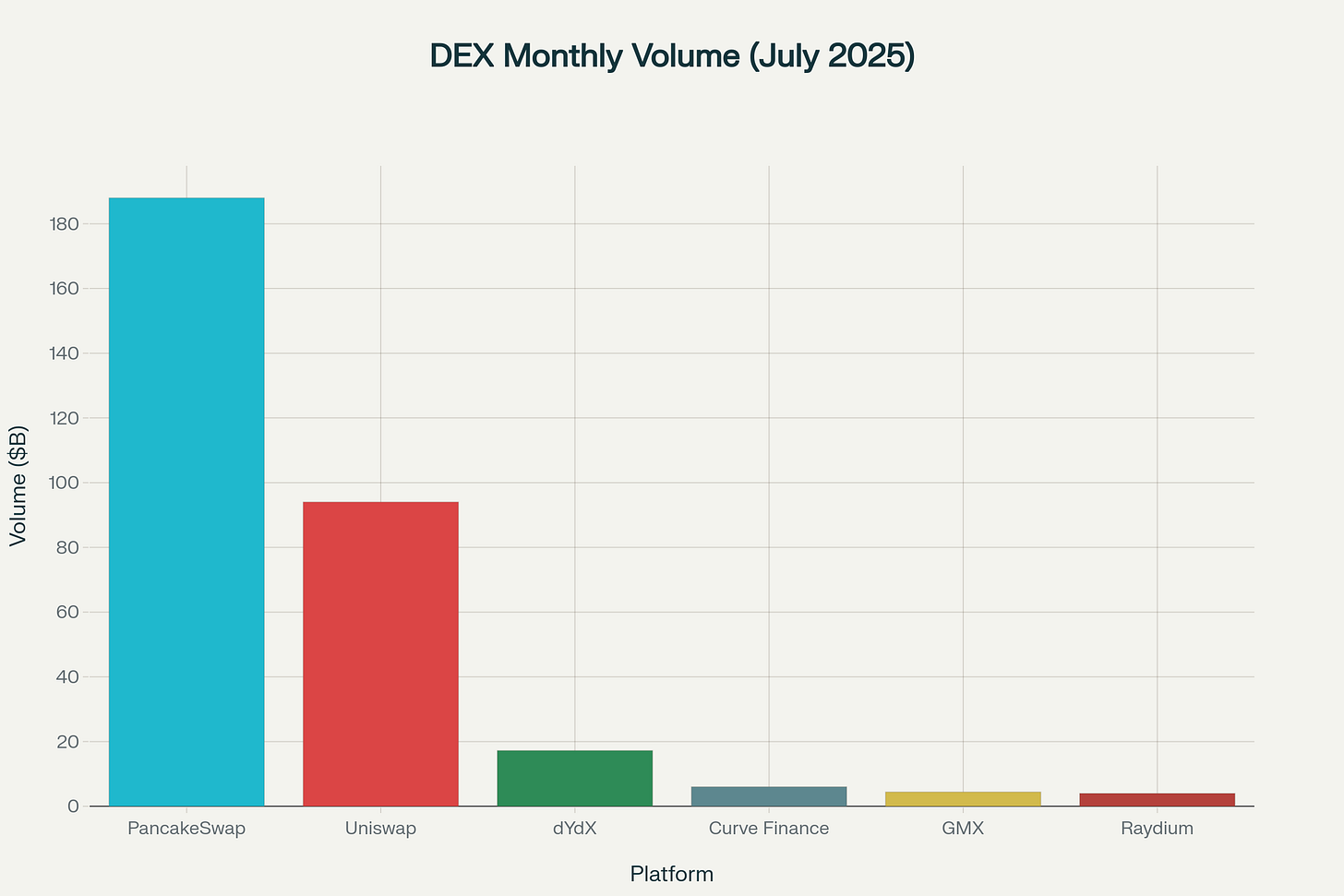

Trading volume dominance among major decentralized exchanges in July 2025

Market Leadership and Competitive Landscape

The current DEX market structure reflects a fundamental shift in user preferences and technological capabilities that has redefined competitive dynamics across the decentralized finance sector.

PancakeSwap's Market Dominance

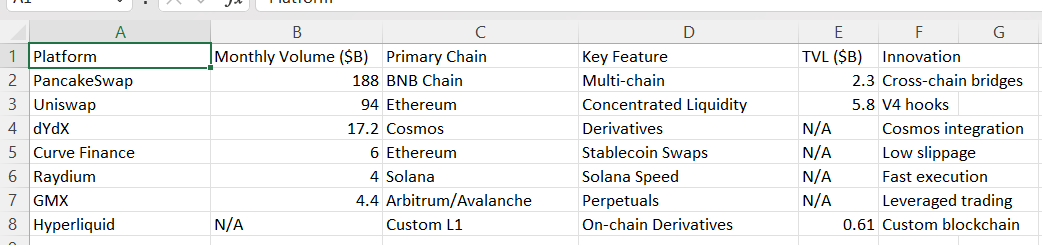

PancakeSwap's ascension to market leadership represents one of the most significant competitive shifts in DeFi history. The platform's $188 billion monthly trading volume in July 2025 established it as the undisputed leader, capturing approximately 43% of total DEX market share. This dominance stems from strategic advantages including multi-chain compatibility across nine blockchain networks, ultra-low fees ranging from 0.20-0.25%, and sophisticated gamification features that include yield farming, prediction markets, and lottery systems.

The platform's growth trajectory has been remarkable, with July representing a 24.5% increase from June's $151 billion volume, while the broader DEX market experienced only moderate expansion. This performance has been driven by strategic initiatives including Binance Alpha integration, the launch of PancakeSwap Infinity with reduced gas fees, and enhanced cross-chain trading capabilities spanning BNB Chain, Ethereum, Arbitrum, and Solana.

Uniswap's Evolution and Strategic Response

Despite losing volume leadership, Uniswap maintains significant competitive advantages with $5.8 billion in Total Value Locked (TVL) and continues to serve as the backbone of the Ethereum ecosystem. The platform processes approximately $6.7 billion in weekly volume with over 6.3 million active traders, demonstrating sustained user engagement. Uniswap's strategic focus on technological innovation, particularly the upcoming Version 4 (V4) upgrade featuring customizable liquidity pools through "hooks," positions it to recapture market share through enhanced capital efficiency and developer-friendly infrastructure.

The platform's concentrated liquidity model introduced in V3 dramatically improved capital efficiency by allowing liquidity providers to allocate capital within specific price ranges, earning higher fees with reduced capital requirements. This innovation has been widely adopted across the ecosystem and remains a core competitive differentiator.

Emerging Players and Specialized Platforms

The DEX landscape increasingly features specialized platforms targeting specific market segments. Hyperliquid has emerged as a dominant force in decentralized derivatives, achieving $610 million TVL with $349 million in monthly inflows during July 2025. The platform's custom Layer 1 blockchain supports up to 100,000 orders per second with sub-second finality, positioning it as a serious competitor to centralized derivatives exchanges.

Curve Finance maintains its position as the preferred platform for stablecoin trading with $1.5 billion in weekly volume, leveraging specialized algorithms that minimize slippage for stable asset pairs. The platform's vote-escrowed CRV model has pioneered innovative tokenomics that reward long-term holders with amplified governance power and fee-sharing benefits.

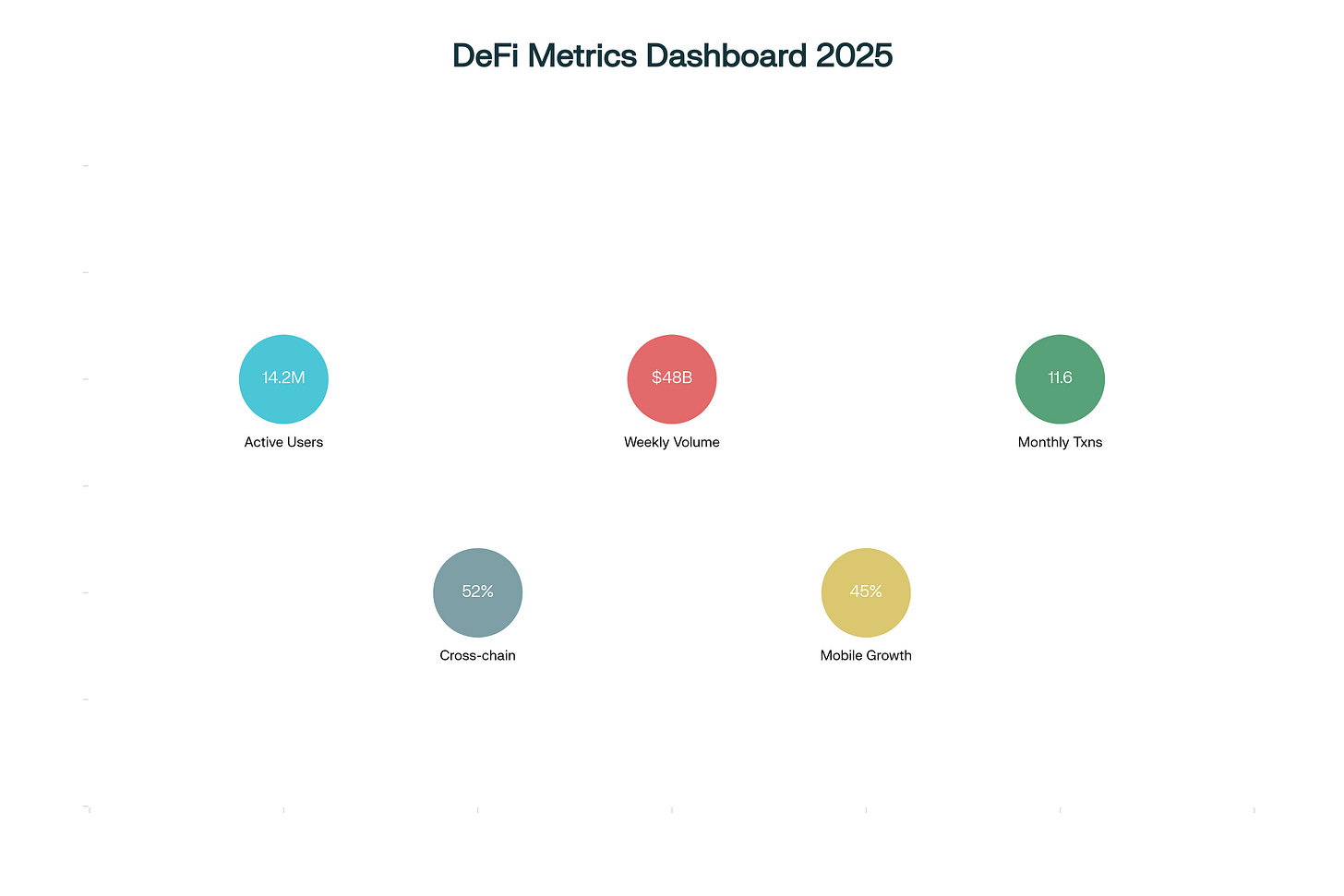

Key DeFi ecosystem growth metrics for 2025 showing user adoption and activity levels

Technological Innovation and Infrastructure Development

The technological foundation of modern DEXs reflects years of research and development focused on solving fundamental challenges of decentralized trading including liquidity fragmentation, capital efficiency, and user experience optimization.

Automated Market Maker (AMM) Evolution

Traditional AMM models utilizing the constant product formula (x*y=k) have evolved into sophisticated systems incorporating concentrated liquidity, dynamic fee structures, and AI-powered optimization. Modern DEXs implement concentrated liquidity AMMs that allow liquidity providers to allocate capital within specific price ranges, increasing capital efficiency and reducing impermanent loss exposure.

Dynamic AMMs represent the next evolutionary step, utilizing algorithms that respond to market volatility by optimizing liquidity provision and adjusting fees based on demand. Kyber DMM exemplifies this approach with dynamic fee structures that change based on market conditions, helping maximize returns during high volatility periods while providing impermanent loss mitigation strategies.

Artificial Intelligence Integration

The integration of AI technologies into DEX infrastructure represents a paradigm shift toward automated, intelligent trading systems. AI-powered market makers utilize machine learning algorithms to track real-time market conditions, optimize liquidity provision, and reduce issues like slippage and inconsistent pricing. These systems employ predictive analytics to forecast price movements, automated trading bots capable of executing thousands of trades per second, and sentiment analysis tools that gauge market sentiment from news articles, social media posts, and blockchain forums.

AI-driven DEX aggregators have become critical infrastructure, with over 38% of institutional DeFi trades now flowing through aggregation protocols that utilize artificial intelligence to optimize trade routing across multiple liquidity sources. These systems analyze vast datasets in real-time, upgrade trade routes, predict market trends, and mitigate risks like impermanent loss.

Cross-Chain Interoperability and Layer 2 Solutions

Cross-chain functionality has evolved from experimental feature to core infrastructure requirement, with 52% growth in cross-chain DeFi activity driven by bridges and Layer 2 expansion. Cross-chain L2 DEX platforms utilize advanced bridge protocols to enable secure asset transfers between multiple blockchain networks, while Layer 2 scaling techniques increase throughput and reduce transaction costs.

The Layer 2 ecosystem now commands over $38.3 billion in combined TVL with daily active users surpassing 2 million. Arbitrum dominates with $2.43 billion TVL, representing approximately 45% of total L2 market share, while processing an average of 2.8 million daily transactions—surpassing Ethereum mainnet by 2.5x. Optimism maintains 99.99% uptime while processing over 420 million transactions since inception, with its OP Stack technology now powering 59% of all Layer 2 startup activity.

Regulatory Challenges and Compliance Evolution

The regulatory landscape surrounding DEXs presents complex challenges that require innovative solutions balancing decentralization principles with compliance requirements.

Know Your Customer (KYC) and Anti-Money Laundering (AML) Compliance

Traditional regulatory frameworks designed for centralized entities struggle to address DEX operations that are inherently borderless and often anonymous. The fundamental challenge lies in DEXs' pseudonymous nature, which conflicts with KYC requirements that mandate identity verification and AML protocols that require transaction monitoring.

Several DEX platforms are implementing optional KYC layers where users can access additional features through identity verification while maintaining basic services without KYC requirements. Others embrace decentralized identity (DID) solutions that allow users to prove eligibility or reputation without revealing personal information, creating a compromise between privacy and regulatory compliance.

Jurisdictional Complexities and Enforcement Challenges

DEXs operate across multiple jurisdictions simultaneously, creating complex regulatory overlap where platforms may be subject to different rules in various countries. India's regulatory approach exemplifies these challenges, with authorities requiring registration with FIU-IND and PMLA compliance while implementing 1% TDS on crypto trades—mechanisms difficult to enforce on decentralized platforms.

The European Union's Markets in Crypto-Assets (MiCA) regulation, fully applicable since December 30, 2024, provides a unified framework for crypto assets across EU member states, covering transparency, disclosure, authorization, and supervision of transactions. This comprehensive approach encourages financial institutions to integrate digital assets while maintaining regulatory oversight.

Smart Contract Security and Risk Management

DEX security challenges have intensified with the platform's growing sophistication and value locked. The OWASP Smart Contract Top 10 (2025) identifies access control vulnerabilities as the leading cause of financial losses, resulting in $953.2 million in damages in 2024 alone. Price oracle manipulation represents another critical vulnerability, where attackers exploit poorly designed oracle mechanisms to artificially inflate or deflate asset prices.

MEV (Maximal Extractable Value) has become a significant concern, with $1.26 billion estimated total MEV revenues on Ethereum since September 2022. MEV extraction strategies including sandwich attacks, arbitrage opportunities, and liquidation events can disadvantage regular users while concentrating profits among sophisticated actors.

User Experience and Adoption Metrics

The evolution of DEX user experience reflects a maturing ecosystem focused on accessibility, mobile optimization, and seamless onboarding processes.

User Growth and Engagement Patterns

The DEX ecosystem now serves 14.2 million active wallets globally, with users conducting an average of 11.6 transactions monthly. Mobile wallet usage has grown by 45%, now comprising 58% of total users, reflecting the industry's successful pivot toward mobile-first design principles. First-time DeFi user onboarding increased by 29%, driven by platforms offering gasless transactions and simplified user experiences.

Weekly DEX trading volume averaged $18.6 billion in Q2 2025, representing a 33% year-over-year increase. More than 9.7 million unique wallets interacted with DEXs by mid-2025, up from 6.8 million the previous year, demonstrating sustained growth in user adoption.

Geographic and Demographic Trends

DeFi usage now spans more than 110 countries, with Gen Z (ages 18-25) comprising 38% of first-time DeFi wallets in 2025. This demographic shift reflects successful efforts to improve user experience and educational resources, making decentralized finance more accessible to younger, tech-savvy users.

The global DeFi search interest index reached 92 out of 100 in Google Trends, marking its highest level in 18 months and indicating sustained mainstream interest. This search activity correlates with increased user onboarding and platform experimentation across geographic regions.

Platform Usability Improvements

Modern DEX platforms have significantly improved user experience through intuitive interfaces, one-click trading, and integrated wallet connections. DEX aggregators like 1inch and Matcha processed over $3.9 billion in routing volume weekly, demonstrating user preference for platforms that optimize execution across multiple liquidity sources.

Average DEX fees have dropped to 0.18%, making decentralized trading more competitive with centralized exchanges. This fee compression reflects both technological improvements and increased competition among platforms seeking to attract volume-sensitive users.

Institutional Adoption and Enterprise Integration

The institutional embrace of DEX infrastructure represents a fundamental shift toward enterprise-grade decentralized finance solutions that meet regulatory and operational requirements.

Corporate Treasury Management and Investment Strategies

Institutional investors increasingly view DEXs as legitimate components of balanced investment strategies rather than speculative trading venues. Corporate treasury management strategies now incorporate DeFi protocols for yield generation, liquidity management, and portfolio diversification. Companies can earn steady returns while maintaining liquidity by allocating portions of their treasury to stablecoin yield farms and staking mechanisms.

The approval of Bitcoin ETFs has brought $9.7 billion in inflows as of February 2024, indicating strong institutional confidence in digital assets. Notable corporate adopters like Tesla ($1.5 billion Bitcoin investment) and MicroStrategy (continuous Bitcoin accumulation) have validated cryptocurrencies as corporate assets, inspiring similar strategies across various industries.

Regulatory-Compliant DEX Solutions

Financial institutions are implementing compliance-focused DEX implementations with optional identity verification, professional trading tools, and enhanced risk management systems that approach centralized exchange standards. These solutions integrate with traditional finance through regulated access points while maintaining the core benefits of decentralized architecture.

Custody services provided by major institutions like Fidelity and BNY Mellon address critical barriers to institutional investment by offering secure, regulated environments for holding cryptocurrencies. These services mitigate risks associated with theft and hacking while providing institutional-grade security and compliance.

DEX Aggregation and Liquidity Optimization

DEX aggregation protocols have become enterprise trading middleware, with 38% of institutional DeFi trades flowing through platforms like 1inch, CoW Swap, and OpenOcean. These aggregation layers provide best execution across dozens of chains while mitigating slippage and unifying fractured liquidity.

Institutional adoption drivers include regulatory clarity growth, institutional volume deepening, and the recognition that aggregation layers are critical infrastructure in a multi-chain world where liquidity is increasingly fragmented. These platforms function as sophisticated backend infrastructure that stitches fragmented liquidity together, ensuring optimal execution with minimal effort.

Economic Models and Tokenomics Innovation

The economic architectures underlying DEX platforms have evolved into sophisticated systems that align stakeholder incentives while creating sustainable value accrual mechanisms.

Governance Token Evolution and Utility Models

Modern DEX tokens serve multi-dimensional utility functions extending beyond simple governance rights. Uniswap's UNI token governs the most widely integrated AMM ecosystem with $5.8+ billion TVL and controls approximately $3 billion in treasury funds managed by UNI governance. The token's significance stems from its role in protocol fee governance, treasury management, and technical innovation direction.

PancakeSwap's CAKE token implements sophisticated deflationary mechanisms through systematic fee burns, buyback programs, and yield farming incentives. The platform's dual tokenomics model combines utility functions (staking, farming, governance) with value accrual mechanisms (fee sharing, burn mechanisms) to create sustainable economic incentives.

Yield Farming and Liquidity Mining Innovation

Yield farming has matured into a viable passive income stream with platforms offering sophisticated compounding strategies and risk-adjusted returns. Advanced compounding techniques include auto-compounders that automatically harvest and reinvest rewards, recursive lending strategies, and protocol stacking across multiple platforms.

Modern yield farming strategies range from simple single-asset staking (4% APY plus bonus tokens) to complex protocol stacking that can achieve triple-digit APYs while exposing capital to cumulative protocol risks. Risk-adjusted approaches balance reward potential with smart contract vulnerability exposure and impermanent loss mitigation.

Fee Distribution and Value Accrual Models

DEX fee structures have evolved to balance competitive pricing with sustainable revenue generation. Hyperliquid implements an innovative model where 97% of protocol fees are allocated to token buybacks, creating upward pressure on HYPE token value. The platform's Assistance Fund launched in January 2025 has accumulated 28.5 million HYPE tokens valued at $1.3 billion.

Revenue sharing mechanisms across DEX platforms increasingly incorporate governance participation rewards, liquidity provision incentives, and trading volume rebates. These models create network effects where increased usage generates higher returns for participants, driving sustainable growth and user retention.

Security Infrastructure and Risk Management

The security landscape for DEX platforms encompasses smart contract vulnerabilities, economic attack vectors, and operational risks that require comprehensive risk management frameworks.

Smart Contract Security and Audit Practices

Smart contract security remains paramount with over $112 billion locked in DeFi by mid-2025, where even minor vulnerabilities can result in massive losses. Regular code audits and comprehensive testing protocols including unit testing and integration testing are essential for identifying and rectifying potential vulnerabilities before deployment.

Multi-signature wallets provide additional security layers by requiring multiple private keys to authorize transactions, reducing single points of failure and preventing unauthorized access. Smart contract verification processes ensure thorough auditing and vulnerability assessment before deployment to production environments.

MEV Mitigation and Fair Sequencing

Maximal Extractable Value (MEV) represents a significant challenge with $1.26 billion in estimated total revenues on Ethereum since September 2022. MEV extraction strategies including sandwich attacks, front-running, and arbitrage opportunities can disadvantage regular users while concentrating profits among sophisticated actors.

Fair sequencing services and MEV mitigation protocols are being developed to address these challenges through batch ordering mechanisms, commit-reveal schemes, and encrypted transaction pools that prevent malicious reordering. Some platforms implement MEV sharing mechanisms that distribute extracted value back to users affected by these activities.

Bridge Security and Cross-Chain Risks

Cross-chain bridge security remains a critical concern as bridge exploits have resulted in some of the largest DeFi losses in recent years. The Ronin Bridge exploit resulted in over $600 million stolen, highlighting weaknesses in bridge contract audits and cross-chain validation mechanisms.

Modern bridge architectures implement multi-validator consensus mechanisms, fraud proof systems, and economic security models that require significant stake from validators to ensure honest behavior. Time-locked withdrawals and challenge periods provide additional security layers for cross-chain asset transfers.

Future Trends and Market Outlook

The DEX ecosystem's evolution toward 2026 and beyond reflects several converging trends that will reshape decentralized finance infrastructure and user experiences.

TradFi-DeFi Convergence and Hybrid Models

The convergence of Traditional Finance (TradFi) and DeFi represents a fundamental shift toward interoperable financial systems. Hybrid models that combine centralized compliance frameworks with decentralized execution mechanisms are emerging as practical solutions for institutional adoption. These systems leverage TradFi's credibility and liquidity while incorporating DeFi's automation and efficiency.

Regulated DeFi platforms are being developed that integrate Know Your Customer (KYC) protocols while maintaining decentralized architecture. These solutions address institutional requirements for compliance and consumer protection without compromising the core benefits of decentralized finance.

Artificial Intelligence and Automation Enhancement

AI-powered DEX development continues advancing with machine learning models trained on historical crypto market data and real-time trading operations. Automated trading strategies powered by sophisticated AI algorithms provide optimal yields while conducting risk management and portfolio optimization.

AI-based market making is evolving to include predictive analytics, sentiment analysis, and automated arbitrage detection that can operate across multiple chains and trading pairs simultaneously. These systems promise to democratize sophisticated trading strategies previously available only to institutional players.

Infrastructure Scalability and Performance Optimization

Layer 2 scaling solutions are expected to achieve 90% fee reductions through proto-dank sharding (EIP-4844) implementation across major L2 platforms. Specialized L2s for specific use cases, particularly AI computation and privacy-focused applications, will emerge alongside standardized cross-L2 interoperability protocols.

Blockchain infrastructure improvements including increased decentralization of sequencers and validators will enhance security while maintaining performance gains. Integration with traditional finance systems through regulated bridges and institutional-grade services will facilitate broader adoption.

Conclusion

The decentralized exchange landscape in 2025 represents a mature, sophisticated ecosystem that has successfully addressed many early challenges while creating new opportunities and complexities. PancakeSwap's emergence as the volume leader with $188 billion monthly trading demonstrates how strategic focus on multi-chain compatibility, user experience optimization, and cost efficiency can reshape competitive dynamics in decentralized finance.

The technological foundation of modern DEXs reflects years of innovation in automated market making, artificial intelligence integration, and cross-chain interoperability. With over 14.2 million active users globally conducting 11.6 transactions monthly, the ecosystem has achieved mainstream adoption while maintaining the core principles of decentralization and self-custody.

However, significant challenges remain. Regulatory frameworks struggle to address the borderless, pseudonymous nature of DEX operations, while security concerns including MEV extraction, smart contract vulnerabilities, and bridge exploits continue to pose risks to users and capital. The emergence of sophisticated attack vectors alongside growing TVL creates an environment where security infrastructure must continuously evolve.

The institutional adoption trend, evidenced by 38% of institutional DeFi trades flowing through aggregation protocols, signals a fundamental shift toward enterprise-grade decentralized finance. This convergence of traditional finance and DeFi principles promises to create more robust, compliant, and accessible financial infrastructure while preserving the innovation and efficiency benefits that make decentralized exchanges attractive.

Looking forward, the successful DEX platforms of 2026 and beyond will likely be those that effectively balance innovation with security, accessibility with compliance, and decentralization with operational efficiency. As artificial intelligence enhances trading capabilities, Layer 2 solutions reduce costs, and regulatory frameworks provide clarity, decentralized exchanges are positioned to become critical infrastructure in a more open, efficient, and inclusive global financial system.

References:

1. https://university.mitosis.org/pancakeswap-solidifies-lead-as-largest-dex-by-spot-trading-volume-in-july-2025/

2. https://www.ainvest.com/news/hyperliquid-tvl-surges-32-610m-349m-inflows-hype-gains-19-2508/

3. https://www.rapidinnovation.io/post/amm-types-differentiations

4. https://cryptorank.io/news/feed/e48e8-pancakeswap-trading-volume-leads-dex-market

5. https://holder.io/news/solana-defi-tvl-rises-30-to-8-6b/

6. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5147234

8. https://cryptoslate.com/polygon-defi-tvl-jumps-43-in-2025-as-quickswap-polymarket-lead-inflows/

9. https://klever.io/blog/all-about-automated-market-maker-amm/

10. https://financefeeds.com/pancakeswap-doubles-uniswap-volume-takes-top-dex-spot-again/

11. https://www.statista.com/statistics/1263975/ethereum-binance-share-in-defi-tvl/

12. https://coinmarketcap.com/academy/article/uniswap-vs-pancakeswap

15. https://academy.youngplatform.com/en/blockchain/ethereum-layer-2-polygon-vs-arbitrum-vs-optimism/

16. https://agrudpartners.com/decentralized-exchanges-dex-india-crypto-compliance/

17. https://www.suffescom.com/blog/how-to-develop-a-cross-chain-dex-aggregator

18. https://www.starknet.io/blog/layer-2-scaling-solutions/how-layer-2-scaling-improves-defi/

19. https://rango.exchange/learn/decentralized-finance/Global-Crypto-Policies-DEX

20. https://www.nadcab.com/blog/cross-chain-bridges-in-dex

21. https://dexola.com/blog/scaling-ethereum-top-layer-2-solutions-in-2024/

22. https://www.idenfy.com/blog/dexs-and-kyc/

23. https://www.chainup.com/blog/most-popular-decentralized-exchanges-dexs/

25. https://www.extractor.live/blog/dex-security-best-practices-how-to-secure-your-protocol

26. https://arxiv.org/html/2406.02172v1

27. https://www.pixelwebsolutions.com/defi-yield-farming-platform-development/

29. https://www.nadcab.com/blog/smart-contract-risks

31. https://www.nadcab.com/blog/dex-governance-tokens

33. https://www.coindeveloperindia.com/blog/defi-yield-farming-development/

34. https://rango.exchange/learn/decentralized-finance/DEX-Tokens-Decentralized-Crypto

35. https://www.linkedin.com/pulse/smart-contract-security-audits-tools-best-practices-2025-chvwc

36. https://www.linkedin.com/pulse/owasp-reveals-top-10-smart-contract-vulnerabilities-eyfte

37. https://ethereum.org/en/developers/docs/mev/

38. https://www.linkedin.com/pulse/how-ai-revolutionizing-crypto-trading-decentralized-exchanges-jcasc

40. https://www.johnnybitcoin.com/what-is-mev

41. https://www.blockchainappfactory.com/ai-powered-decentralized-exchange-development

42. https://www.linkedin.com/pulse/convergence-traditional-finance-tradfi-decentralized-rastogi--gqjjf

43. https://chain.link/education-hub/maximal-extractable-value-mev

44. https://www.codezeros.com/how-aipowered-market-makers-are-changing-the-dex-landscape

45. https://hedera.com/learning/decentralized-finance/tradfi

46. https://zerocap.com/insights/research-lab/maximal-extractable-value/

47. https://ideausher.com/blog/ai-powered-dex-aggregator-development/

48. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5133479

50. https://aisel.aisnet.org/amcis2025/sig_dite/sig_dite/19/

51. https://coinlaw.io/decentralized-finance-market-statistics/

52. https://www.mexc.com/price-prediction/dex-message

54. https://www.linkedin.com/pulse/digital-employee-experience-dex-management-software-jduuc/

56. https://socialcapitalmarkets.net/crypto-trading/defi-statistics/

57. https://www.linkedin.com/pulse/digital-employee-experience-dex-management-software-market-c0gof/

58. https://www.ulam.io/blog/institutional-adoption-of-cryptocurrency

59. https://www.statista.com/statistics/1297745/defi-user-number/

60. https://www.statista.com/outlook/fmo/digital-assets/defi/worldwide

61. https://www.chainup.com/blog/dex-aggregators-institutional-defi/

62. https://www.linkedin.com/pulse/dexs-2025-infrastructure-adoption-why-matters-lampros-tech-whiqf